A mother of a Minor detained by a pastor is seeking justice from the court.

In application filed at Employment and Labour Relations Court,seeking orders to have the Child who is 16 years released by Pastor Daniel Owino.

The minor is allegedly facing criminal charges at a Ngong law courts, her mother has filed an application at the employment and labour relations courts seeking to stop the said proceedings.

Esther Beja a resident of Kwale, through city lawyer Elizabeth Ochieng says that the responded who is a pastor has been engaging in a ring of child abuse,child trafficking and labour.

In the application, the applicant is seeking court orders to have the respondent restrain from verbally engaging the applicant,the applicant family and friends or any other person associated with the applicant.

She also added that the applicant be restrained from harrassing, intimidating stalking and engaging in any behaviour which amounts to emotional,verbal or psychological abuse of the applicant.

Mrs Beja further accused the respondent of using the minor to perform households duties despite the fact that he had agreed to take the child to school while under his custody.

“In a sudden twist of event,the respondent started engaging the minor in a household chores in stead of taking her to school” said the lawyer.

In the matter, it is alleged that Mrs X a minor who is charged with malicious damaged to property was staying with Daniel Egesa.

According to the charge sheet,it’s alleged that she damaged a television valued at Ksh 33,990 the property of Daniel Egesa,the offence is alleged to have been committed on the January 13th 2025 in Ongata Rongai township.

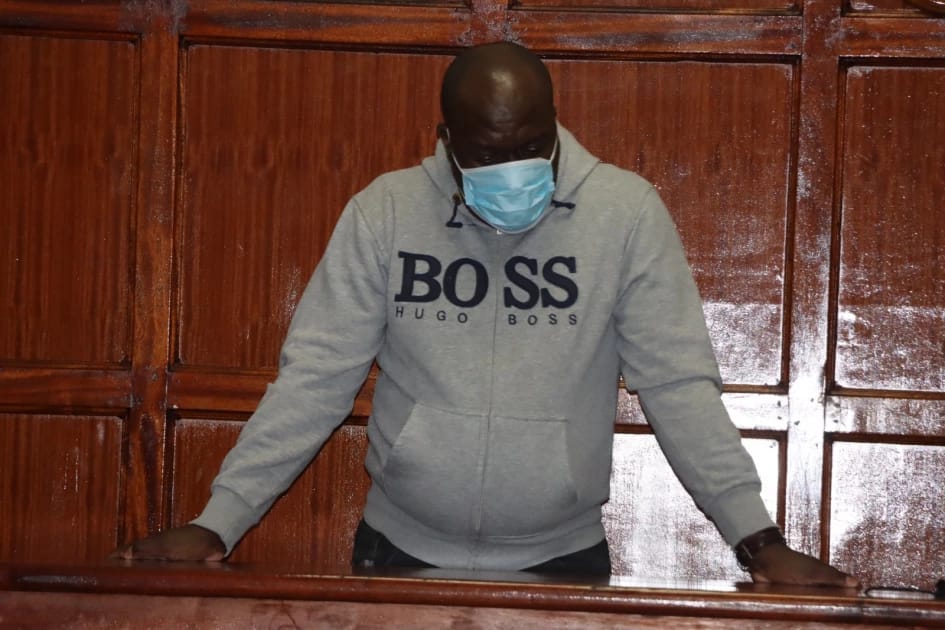

Due to financial constraints of the family, former Nairobi governor Mike Mbuvi Sonko came to the rescue of the minor by securing her bond terms.

Speaking in Ngong during the mention,Sonko told the journalist that he was willing and ready to take the minor to school so that she can achieve her dream.