Unclaimed Financial Assets Authority (UFAA) has partnered with Huduma Kenya to deepen access to Authority services.

The authority through its Chairman Richard Kiplagat,says the move will ease the burden of accessing the service and follow-ups by claimants at their county.

“The successful implementation of this framework will lead to enhanced access to UFAA services by members of the public and therefore facilitate UFAA in meeting its reunification mandate, “said Kiplangat while speaking to the press at a Nairobi Hotel.

He said the collaboration will also strengthen Huduma Kenya’s shared services model that enhances cost-effectiveness and efficiency in public service delivery.

“In addition, we are operationalizing a contact center solution to enhance customer experience. The call center solution is purposed to hand hold claimants through the reunification journey, “he added.

UFAA at the same time announced that so far the surrendered assets have grown exponentially from Sh 300 million in 2014 to Sh 20.3billion in cash and one billion units of shares.

Kiplangat said they have received cumulative claims amounting to Sh 1.2 Billion from 17,469 claimants so far.

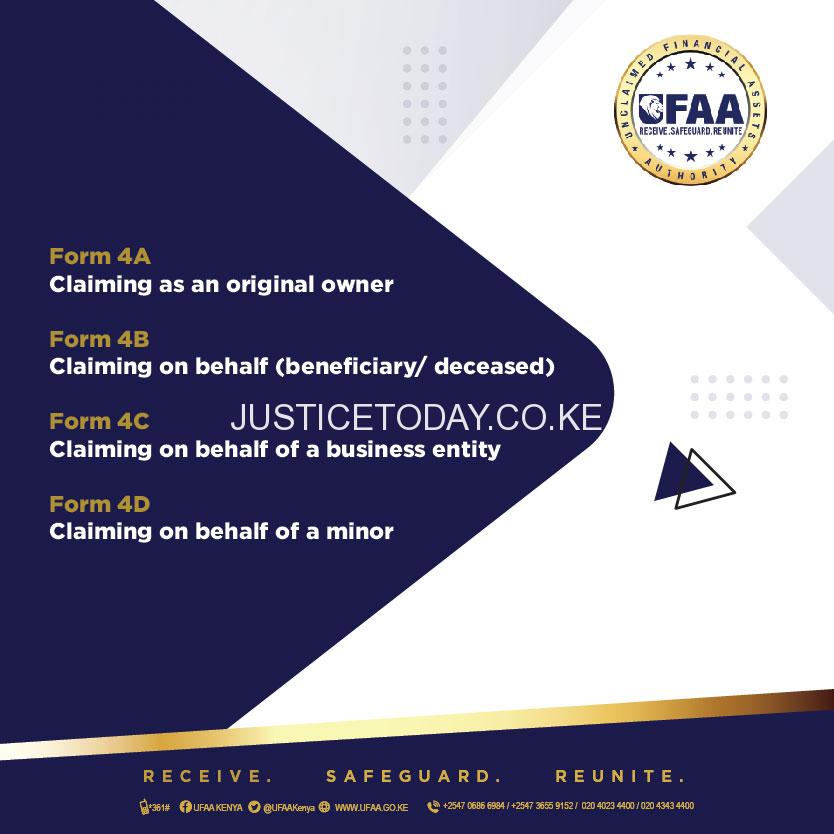

The Authority is also doing away with manual filing of claims to facilitate easier processing and disbursement of unclaimed financial assets in cash, bonds, stocks and other financial assets.

In place of this manual system, an online system has been developed and deployed to facilitate filing, processing and disbursement of unclaimed financial assets to rightful owners and beneficiaries.

UFAA is also deploying an online holders’ reporting and surrenders system that will make it easier for holders to submit and surrender unclaimed financial assets in their possession.

In a couple of days, the deadline to surrender unclaimed financial assets qualifying as at June

2021 will lapse. Holders are obligated to file a report concerning the assets to the Authority on or before the first day of November of each year. The reports are for assets qualifying in the accounting year ending on the thirtieth day of June.

To ensure that the compliance rate by holding institutions grows, the UFAA has also partnered with the Office of the Auditor General to facilitate audits of public sector agencies on compliance with unclaimed financial assets reporting and surrender.

The UFA Act empowers the Authority to examine records to determine whether the holder of unclaimed financial assets has complied with its provisions. The law also provides for timelines within which unclaimed financial assets in holders’ possession are to be reported to UFAA.

UFAA is an authority created under the Unclaimed Financial Assets Act, No 40 of 2011 to administer unclaimed financial assets. UFAA’s primary focus is to receive unclaimed financial assets from the holders, safeguard the assets and reunite the assets to their rightful owner.

The authority says that a survey commissioned to assess the quantum of unclaimed financial assets holding in the market show complacency on part of holders. The survey reported that an approximate Ksh241billion in unclaimed assets is being held by about 490, 000 institutions.